tax strategies for high-income earners 2020

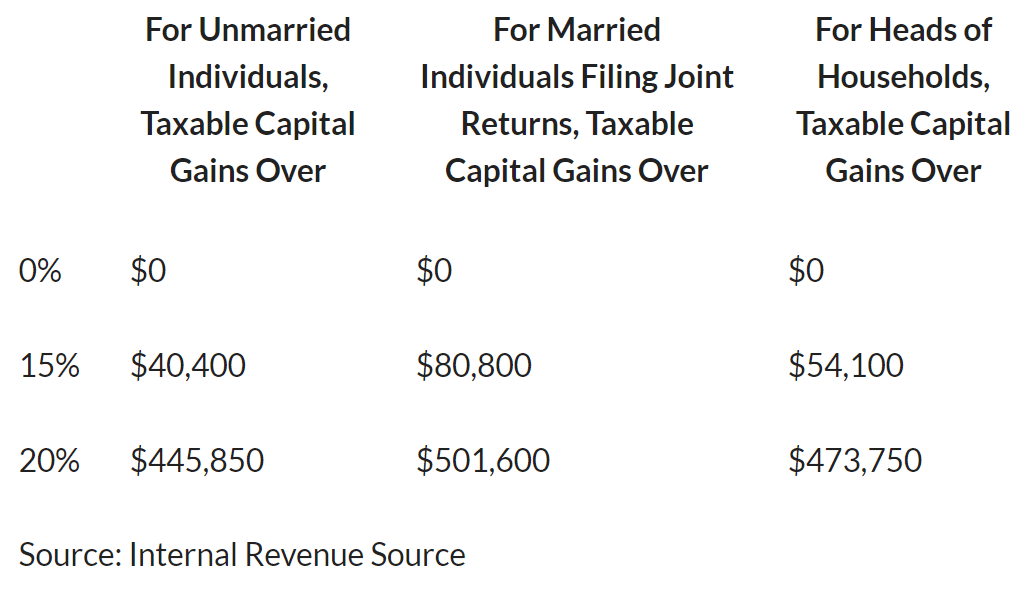

Thats especially true if you earn more than 400000 as. Higher-income earners pay a significantly higher percentage of their income to the IRS than lower-wage earners.

Year End Tax Strategies For High Income Earners

What Are the Tax Strategies of High Earners.

. Weve got one month left. For 2022 the maximum employee deferral to 401 k is 20500. Grab your 2020 tax return and your most recent pay stub.

1441 Broadway 3rd Floor New York NY 10018. 6 Tax Strategies for High Net Worth Individuals. Qualified Charitable Distributions QCD 4.

Tax strategies for high-income earners 2020. When you earn a high income you tend to pay a higher percentage of. Lets start by reviewing 1040 on your 2020 tax return.

As shown below deductions nearly. Tax strategies for high-income earners can be sometimes misunderstood. Thats important to understand because you might assume that high-income earners are people making 400000 500000 or more each year.

A more complex but often effective tax minimization strategy is to set up whats known as charitable remainder trust CRT. In this article well look at the most common types of tax strategies for high-income earners and how you can make the most use of them. If you are over age 50 you can contribute an additional 6500 per year in catch-up contributions meaning you can.

Consider using above-the-line deductions to help reduce your adjustable gross income AGI. Tax Planning Strategies for High-income Earners. The 2022 annual limit is 20500.

We recommend doing a trial tax return before year-end to assess your tax implications thus allowing for current year action to maximize tax opportunities. How to Reduce Taxable Income. Mon - Fri.

Read our blog to find out what exactly they are. This post was originally published May 27 2020 and extensively updated December 17 2021. A great tax saving strategy for self-employed high income earners is to record and track all of your business expenses.

You can also read our guide on 7 secrets to high net worth investment management estate tax and financial planning. Its possible that you could. If your work or assets generate.

The Tax Cuts and Jobs Act TCJA signed into law December 2017 and implemented in 2018 is currently set to sunset after 2025. Tax Strategies for High-Income Earners. Converting some of your retirement account funds to a Roth is one of the most counter-intuitive tax strategies for high-income.

These deductions are allowed even if you. July 24 2020 225242. Use Roth Conversions Wisely and Regularly.

In fact Bonsai Tax can help. Trial Tax Return. Year-End Tax Strategies for High-Income Earners.

The current top marginal tax rate in the US is 37. And things are about to get worse if President Biden gets his way. FAQ Blog 247 Customer Support 1 855 906-2266.

Our tax receipt scanner app will scan.

Kysondra Elliott Ea Cts I Help Executives And High Income Earners Keep More Of Their Tax With Advanced Tax Strategies Yes You Can Save Forget What Your Cpa Said

5 Outstanding Tax Strategies For High Income Earners Debt Free Dr Dentaltown

Tax Strategies For High Income Earners The Trial Tax Return

9 Ways For High Earners To Reduce Taxable Income 2022

Episode 67 Investing For High Income Earners Wealthability

Tax Reduction Strategies For High Income Earners 2022

Tax Reduction Strategies For High Income Earners 2022

The 4 Tax Strategies For High Income Earners You Should Bookmark

5 Outstanding Tax Strategies For High Income Earners Debt Free Dr Dentaltown

Tax Strategies For High Income Earners

High Income Earner Tips To Optimize Your 2020 Tax Return Davis Wealth Advisors

Biden Tax Plan And 2020 Year End Planning Opportunities

Irs To Examine High Income Earners Develop A Strategy

The 4 Tax Strategies For High Income Earners You Should Bookmark

The 4 Tax Strategies For High Income Earners You Should Bookmark

5 Outstanding Tax Strategies For High Income Earners